[ad_1]

Think Jack Dorsey's jobs are tough? Well, Tom Chavez works for six startups. He believes that building a business can be summed up in science, so today he unveils his laboratory to establish, finance and operate companies. He and his team have already proven that they can do it themselves after selling their startups Rapt To Microsoft and Krux to Salesforce for $ 1.2 billion. They have now raised a $ 65 million fund for "super {set}", an enterprise startup studio with half a dozen companies currently operating.

The idea is that the supercar is either conceiving a company or bringing in founders who dream of achieving it. The studio provides early financing and expertise while the startup company operates from its common space in San Francisco, as well as my future in New York and Boston. The secret sauce is "super {set} Code", an executive book plus technology tools and building blocks that guide strategy and eliminate redundant work. "We believe we can make companies 10x faster and increase capital efficiency by 5X," says Chavez about his partnership with super-founders Vivek Vidya, who works as CTO, and Jay Lim who runs the fund.

Super team {set} (left): Tom Chavez, Jay Lim, Jane Elena, Jeremy Klein and Vivek Vidya

Perhaps the question is not whether the startups of the portfolio can expand, but whether the humans behind them can without breaking. It is stressful to run a single company, let alone six. Even as operations are narrowed down, each faces unique challenges and there is no plan that fits all. But after offering 17.5X returns for its former investors, Chavez et al. It has proven its ability to realize what businesses need again and again and to create boring products that are recognized but abundant in managing customer data and ad revenue.

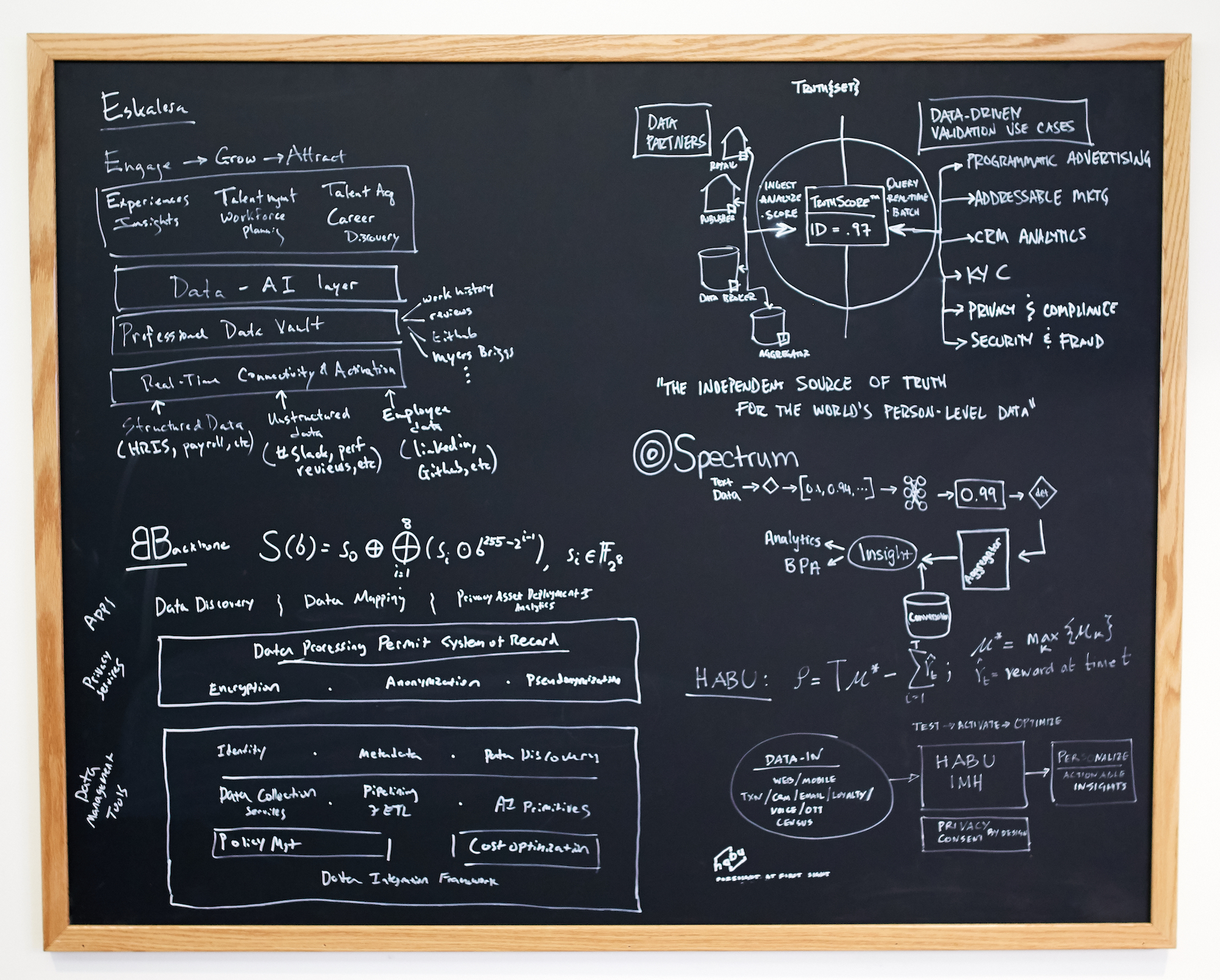

Studio play books cover business plan formation, pitch strategies, market going, revenue, machine learning, principles of management, human resources operations, sales methods, pipeline measurement, product sequencing, finance, legal, and much more. There is also a common engineering code it provides, so there's no need to restart the wheel on startup. "I don't think you can regulate it, but I think you can speed up and reduce risks," Chavez explains.

super {set} Code

Today, the first super company {set} comes out of the Ghost. Eskalera assists companies in retaining the best talent by tracking employee diversity and inclusion to engage them in career growth and community programs. Chavez is the CEO, but he plans to install a new one soon so he can focus on more time to start more startups. There are 55 employees in the first six companies, with two companies already generating revenue and those most willing to appear in the next nine months.

Eskalera and other major {set} financing comes on unique terms. Because Chavez and the team are not only board members that you hear from once every quarter but they “take responsibility with the entrepreneurs” because it is repeated many times in our interview, startups pay more shares for money.

Hope is a seasoned driving aboard worth it. "We are productive first and foremost," Chavez tells me. Who will buy it? Who will buy it? Why a? What is the artistic ditch? We are not people doing jazz. ”The super group {group} has a lot of leather in the game, although it gave Chavez himself a big chunk of $ 65 million , And the fund held a record management fee.

Eskalera

To maximize companies, super {set} gathers expert staff in the field of artificial intelligence, data science, and others who align with the companies most relevant to the portfolio. They get bonus shares to motivate them to work hard on behalf of startups. “What worries me about these big chests is that they have a separate incentive from where they work for the fee,” Chavez says. His fund hopes to win by continuously funding the winners.

Super founder Tom Chavez

If portfolio companies face tough times, Chavez says {set} will stick to it. "My first company had layoffs of multiple employees and a major hub. We had a businessman walked away. Chavez says about the continuation of the march: They lost their conviction, but we brought that company to a $ 180 million exit after people said there was no effective way and that's really good feeling. “Good entrepreneurs have this demonic energy.” But if everyone involved agrees that the project is not working, they will shut it down. “It goes back to the opportunity cost of people's time.”

Chavez is respected for studios that follow different styles, such as Atomic in startups, science in e-commerce, and Pioneer Square Labs, which maintains larger fund employees. What excites me is pushing entrepreneurship a step forward. Why can't we grant this concession in other cities? He hopes the super {{group} will be able to attract the best talent that “just wants to jerk” instead of taking over one company.

Can {{}} SUPER keep all panels revolving and really reducing their risk? “If we are wrong, there will be giant orange columns in the sky. Early returns are promising, but we have to prove it. But after accumulating a lot of wealth for himself, he says that the thrill that keeps him in the startup game is seeing results that changed the life of his teams. The wealth generated by the employees of the companies I created and nothing makes me happier than seeing them pay for tuition, property or retirement. "

[ad_2]