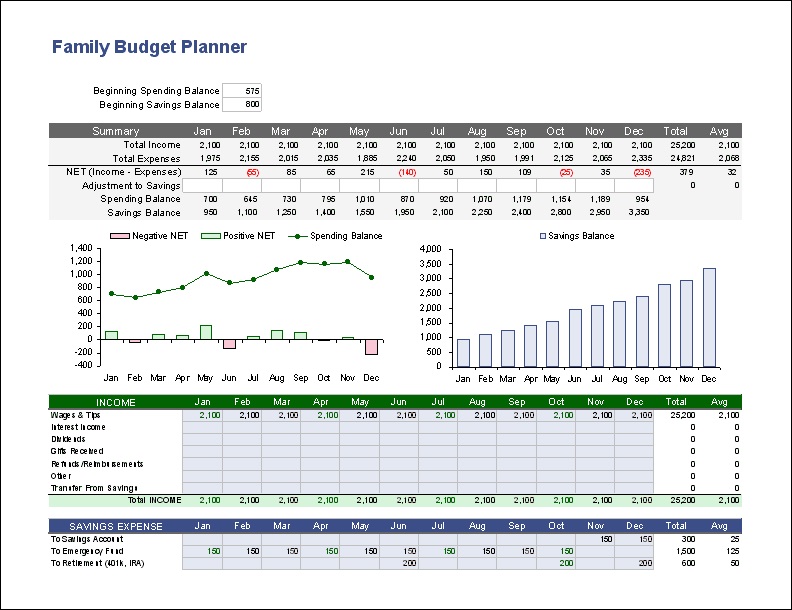

Family Excel Budget Planner: This special family budget planner is built on the spreadsheet that I use to keep track of my personal financial affairs, which you can get here. It proved to be extremely beneficial in dealing with key life events such as the shift from student to married student, from intern to employee, and finally from home owner. We were able to make ends meet thanks to meticulous budgeting, and by the time we were ready to buy a house, we knew precisely how much we could afford.

This spreadsheet has been downloaded and used by hundreds of millions of individuals, and it continues to be one of my most frequently requested budgeting tools. Many individuals, on the other hand, may not be aware that I have just made a few of other variants. Perhaps you’d like to look at the Money Manager template or the annual Budget Calculator for inspiration. Both of these add features to the basic planner that are not available in the basic planner.

Watch the video demonstration below if you’re new to Excel, or if you’re new to budgeting, or if you’re new to either. How to Get Started, Customize Your Budget Categories, Enter Budget Amounts for Each Month, and Determine Whether You Are Under or Over Budget Each Month are all covered in this tutorial.

Download Family Excel Budget Planner

Description – Family Excel Budget Planner

Create an annual budget with this free family budget planner worksheet by entering numbers according to the month in which expenses are incurred. You can use this worksheet to track your spending throughout the year.

Making an annual budget allows you to more accurately estimate how major life changes will effect your financial situation. For example, if you are considering a career change, you can use the planner to see whether an increase (or drop) in compensation will still allow you to meet your financial obligations.

Whether you are relocating or purchasing a home, you can examine your financial situation to see where you may need to make cuts to be able to afford an increase in rent or a higher mortgage payment. Take a look at the video for an illustration.

Version 2.0 includes the following enhancements: Using the new graphs, you can see how your spending and savings balance has changed over time. The percentages listed below the category totals indicate what percentage of the total family budget is allocated to each category in question. The assistance worksheet has been significantly improved.